Staying on top of your credit has never been easier.

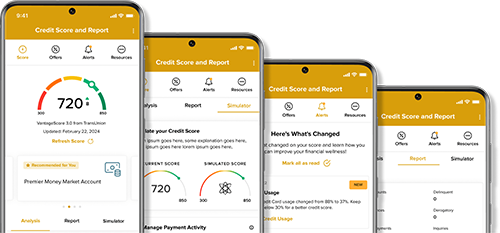

Sandy Spring Bank is making it easier than ever for you to check and better understand your credit. Log in from anywhere through personal mobile or digital banking and instantly check your number with Credit Score by SavvyMoney®.

All of this without impacting your credit score.

You can do this ANYTIME and ANYWHERE and for FREE.

Credit Score is a free resource Sandy Spring Bank is offering to its digital banking clients that shows your current credit score and provides tools to improve it.

- FREE access to your credit score, full credit report and credit monitoring.

- Credit scores update automatically once a week, or you can refresh every day to monitor any changes — all without an impact to your score.

- Use the Score Simulator to see what happens to your score in different scenarios, like paying off a credit card or buying a new car.

- Nothing extra to install or learn, everything is in Personal Digital Banking.

- Keep abreast of any unusual activity on your credit report and be sure to report if you notice something strange.

Credit Score by SavvyMoney® FAQs

-

Question

What is Credit Score by SavvyMoney®?

AnswerCredit Score by SavvyMoney® is a comprehensive platform that provides clients with free and ongoing access to credit scores and reports, real-time credit monitoring, and savings opportunities – all through their personal digital and mobile banking.

-

Question

Is Credit Score by SavvyMoney® really free and how do I register?

AnswerYes. Credit Score by SavvyMoney® is entirely free to use and no credit card information is required to register. In personal digital banking the enrollment link is located to the right side of the accounts screen and in mobile banking it is below the list of accounts.

-

Question

How often are credit scores updated by SavvyMoney®?

AnswerCredit score results are updated and displayed in digital banking every seven days. You can also refresh your score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score Dashboard within digital banking.

-

Question

Will accessing Credit Score by SavvyMoney® impact my credit and potentially lower my credit score?

AnswerNo. Checking Credit Score by SavvyMoney® is always a soft inquiry, which does not affect credit scores. Typically, hard inquiries are used by lenders to make decisions about creditworthiness when users apply for loans. Multiple hard inquiries can lower a credit score.

-

Question

How does Credit Score by SavvyMoney® keep my financial information secure?

AnswerCredit Score by SavvyMoney® has implemented bank-level encryption and security policies to keep our user's data safe and secure. SavvyMoney® also has a sophisticated system that scans for, and thwarts online bots, intrusions, and attacks.

-

Question

Does Credit Score by SavvyMoney® offer credit report monitoring?

AnswerYes. When a user successfully enrolls in the credit score solution, they are automatically enrolled in credit monitoring. Their file is scanned daily for key changes, and an alert is sent when a significant change is detected. These alerts are provided within digital banking and via email. The user can update their email preferences for SavvyMoney® emails by navigating to “Resources” and the “Profile Settings” section.

SavvyMoney® will provide the following monitoring alerts:

- An account has been included in bankruptcy.

- An account is reported as delinquent.

- A fraud alert has been placed on the credit file.

- A previously derogatory account is now current.

- A new account has been opened.

- An account in your name shows a different address.

- An account in your name listed a new employer.

- A new inquiry on the credit file.

- A new public record has been reported.

-

Question

What if the information provided by Credit Score by SavvyMoney® appears to be inaccurate?

AnswerThe Credit Score by SavvyMoney® is not intended to be comprehensive and may not provide all information about user accounts. We encourage users to take advantage of obtaining free credit reports from www.annualcreditreport.com to look for any incorrect information or discrepancies across all three bureaus. Each bureau has its process for correcting inaccurate information, but users can file a dispute by clicking on the “Dispute” link within their SavvyMoney® credit report. For more information about disputes, the Consumer Financial Protection Bureau website offers step-by-step instructions on how to contact the bureaus and correct errors.