What is a CD ladder?

If you're looking for an enhanced savings approach but you want to maintain periodic access to your funds, then Certificate of Deposit (CD) laddering may be a good option for you.

A CD is an FDIC-insured savings product that offers a fixed interest rate for a specific period of time. CD laddering is a financial planning approach in which an individual owns a variety of CDs with staggered maturity dates. Many people deposit equal amounts in each but, as we'll demonstrate, saving varying amounts has its advantages as well. Once the CD matures you have access to your money to spend or, as many people do, purchase another CD.

Why CD ladders are a good strategy

There are two primary benefits to laddering – it frees up portions of your savings at regular intervals and balances out interest rate volatility. This is accomplished by staggering your maturity dates in CDs of varying lengths, allowing you to adapt to changing interest rates.

Building a CD ladder

Once you’ve determined your deposit level and desired dates of maturity, it’s time to build the ladder. Let’s walk through the process using the following example.

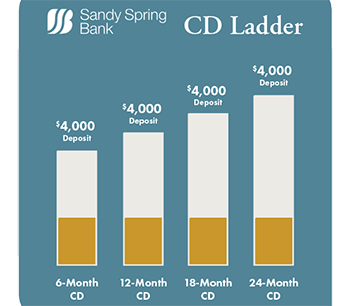

Assume you want to deposit $16,000. Instead of putting the lump sum in one CD, you spread out the $16,000 and deposit $4,000 in four CDs of varying lengths:

6 Month - $4,000

12 Month - $4,000

18 Month - $4,000

24 Month - $4,000

As each matures, you then open a 24-month CD so that after 2 years you would have four 24-month CDs with one maturing every six months.

If rates go up, you will have CDs maturing to take advantage of those new rates. If rates go down, you will still have some longer-term deposits locked in at higher rates.

CD laddering is also a popular savings choice because of its flexibility. Depending on your anticipated needs, you can deposit varying amounts into each CD, allowing for access to the savings at a fixed date. In general, CDs are a worthwhile savings option due to their security with an FDIC-insured financial institution and the higher interest rates offered.

Ready to create your own CD ladder? Reach out to a Sandy Spring Bank banker to review your options, find answers to any questions you may have and get started on the road to greater financial security.

Learn more about Sandy Spring Bank Certificate of Deposits (CDs). »

This material is intended to serve simply as an informational or educational resource and not as investment advice. As your needs, goals and circumstances are unique, please consult a financial professional for advice.