By Laura Newpoff, Contributor The Business Journals Content Studio

Small businesses have made a number of changes to their business models in response to the pandemic and many of those changes are here to stay. The most notable is remote work, which is affecting talent attraction and retention, technology investments and real estate needs.

That’s according to insights from small businesses in the third annual State of Small Business survey conducted by the Washington Business Journal and sponsored again by Sandy Spring Bank. The research focused on understanding how these firms are faring and determining what help they need to succeed.

To read more about the survey methodology and its overall results, including top challenges and investment priorities for small businesses, click here.

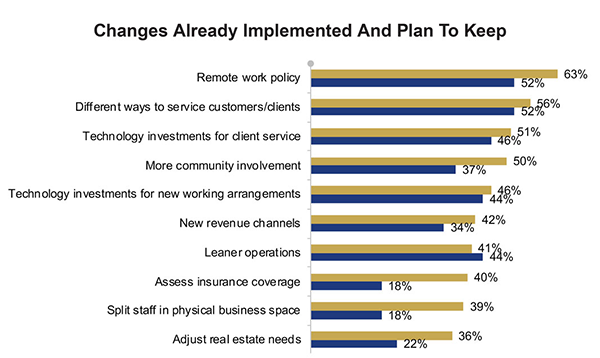

Among the implemented changes small businesses plan to keep — a remote work policy, which was the top response at 63%, up from 52% from 2020.

Small businesses are finding several benefits to maintaining remote work in some form – it’s a perk that helps attract and retain top talent in a tight labor market; it makes schedule flexibility easier to implement; and it keeps employee morale high.

“One of the things that has held up the ability for small businesses to hire above and beyond federal unemployment benefits has been the issue of childcare,” said Hugh Sisson, founder of Heavy Seas Beer in Baltimore. “With schools reopening, remote work takes some of the pressure off folks with children. As a small business owner, you want to protect your personnel infrastructure. If you can accommodate someone who wants to work remotely some of the time, you really should do that if you want to keep a person you value.”

Heavy Seas Beer brews craft beers and operates a taproom. The 50-employee company continues to allow its administrative staff to operate in a hybrid office/remote work manner. Remote communication takes place on the Google platform.

Providing safety and flexibility

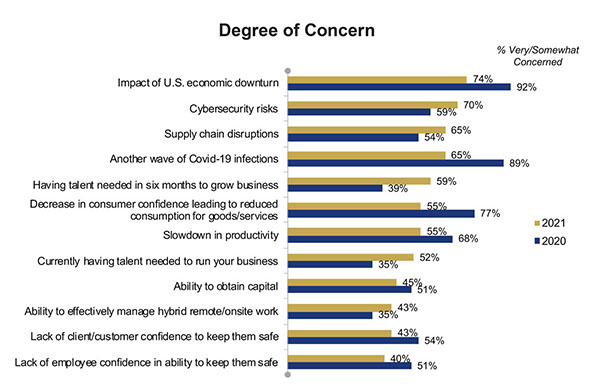

Forty-three percent of survey respondents said they are very or somewhat concerned about the ability to effectively manage hybrid remote/onsite work, up from 35% a year ago. Forty percent are concerned about a lack of employee confidence in the ability to keep them safe, an improvement from 51% a year ago.

The American Bus Association, a Washington, D.C. organization that represents motorcoach, group tour and travel association members, opened its office to its 11 employees in July 2020, but made a policy that only those who were comfortable should come onsite. As the COVID vaccines started to roll out in early 2021, the association required employees get the shot and then encouraged everyone to return to the office this summer.

Today, the organization continues to be flexible with employees who need to work at home for a variety of reasons. One employee, for example, was allowed to work from home for two weeks to care for school-age children while her husband was out of the country.

“We know we have hard workers who will get the job done,” said Peter Pantuso, the association’s president and CEO. “We encourage creating a schedule that works for you and your family. It’s been a sea change, but what we’ve found is that everybody doesn’t always have to be in the same place at the same time. As long as you have the ability to communicate effectively, you can provide the flexibility your employees need.”

For small firms, communication means finding the right technology solution. Forty-six percent of respondents said they have implemented and plan to keep technology investments for new working arrangements, up from 44% a year ago.

The American Bus Association made two key technology investments that have facilitated a hybrid work model. Just before the pandemic, the company invested in the RingCentral Voice over IP system. Its subscription included a video platform it uses to connect with employees and members. The association also recently moved its accounting system into the cloud.

“We’re now prepared to continue operations and serve our members, no matter what the external factors are, even beyond the pandemic – hurricane, flood or fire,” said CFO Eric Braendel, who works from his home in Florida. “If businesses hadn’t moved to subscription-based cloud services before the pandemic, they now know that’s where they have to be for business continuity.”

Changing real estate needs

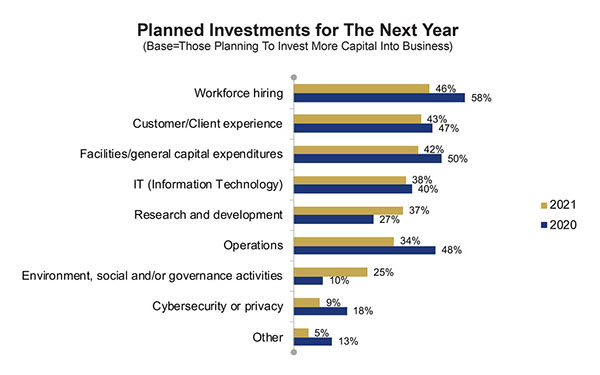

Among business model changes that have been made in the first half of 2021, 33% of respondents said they have adjusted their real estate needs, up from 21% in 2020. Additionally, 42% of respondents who said they plan to invest more capital into their business cited facilities and general capital expenditures as an investment priority, down from 50% a year ago.

Thirty-nine percent expect to split staff in a physical business space, up from 18% a year ago, based on survey responses to questions about changes already implemented. And 36% expect the need to adjust real estate is a consideration that’s here to stay, up from 22% a year ago.

The American Bus Association owns its 9,000-square-foot floor in an office building that is configured like the letter “A.” The organization’s leadership is contemplating a change to its real estate footprint because it has five fewer employees than before the pandemic.

The space was organized so that one ‘leg’ of the ‘A’ could be sectioned off and rented – about 2,000 square feet. The association envisions it could take back that part if it grows in the future. “Since we shrunk, we are now looking at renting part of our current space to a second tenant if the opportunity works,” Pantuso said.

To learn more about how Sandy Spring Bank is helping small businesses grow, click here.

Sandy Spring Bank has more than 50 locations across Maryland, Virginia and Washington, D.C.

Read more Small Business research findings. »

Laura Newpoff is a freelance writer with The Business Journals Content Studio.

Source: The Washington Business Journal’s third annual State of Small Business Survey, sponsored by Sandy Spring Bank.

The Washington Business Journal is not affiliated with Sandy Spring Bank.

This material is provided solely for educational purposes and is not intended to constitute tax, legal or accounting advice, or a recommendation for any particular transaction.

Websites not belonging to this organization are provided for information only. No endorsement is implied.