By Laura Newpoff, Contributor, The Business Journals Content Studio

Small businesses in the Greater Washington, D.C. and Baltimore area continue to have a sense of optimism about their businesses even as they experience a variety of economic headwinds.

They also continue to make investments to grow their businesses so they are competitive in the areas of talent attraction and retention, digital transformation, and marketing their offerings.

These are among key findings from the Baltimore Business Journal’s fourth annual State of Small Business Survey, sponsored again by Sandy Spring Bank. The purpose of the research is to understand how small businesses are faring and what they need to succeed.

“Despite the ripple effects of the pandemic and rising inflation, many businesses feel positive about the direction of the local economy and want to grow their businesses,” said Daniel J. Schrider, president and CEO of Sandy Spring Bank. “We have seen record loan production in our commercial banking enterprise, which is evidence that clients want to invest in the future of their companies.”

A total of 206 responses were collected in this year’s second quarter survey from businesses with under $25 million in revenue. Included was a sub-sample of 105 firms with fewer than 500 employees and revenue under $5 million.

Terry Clower, Northern Virginia chair and professor of public policy at George Mason University, said the ongoing research is important because a strong entrepreneurial ecosystem of small businesses is a key characteristic of a vibrant economy.

“Research like this matters because you want to ensure entrepreneurs and innovators have access to the resources and information they need to realize their dream of starting and succeeding as a small business,” Clower said. “It’s also important to understand if the small business sector is healthy, because they are key to making sure the big business sector is healthy, too. Very few small firms can live without the products and services of larger businesses.”

Here are the survey’s key findings.

Lingering pandemic effects

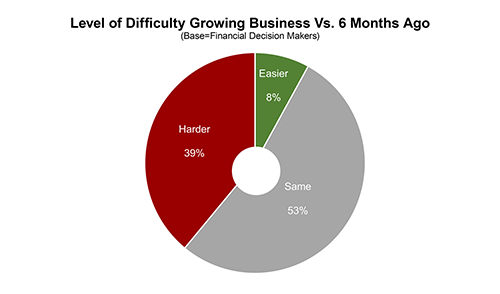

While the majority of respondents believe growth conditions are the same as they were six months ago, there’s a large gap between those who think it is either “easier” or “harder” to grow a business.

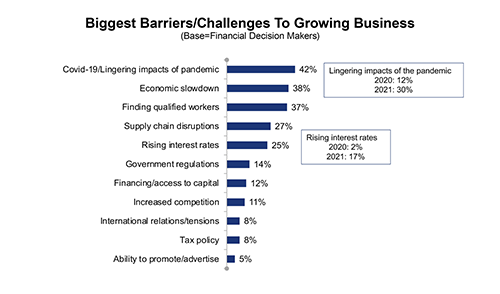

Not surprisingly, the pandemic is the biggest barrier to growth, and it likely is the cause of many of the other pain points small firms are facing.

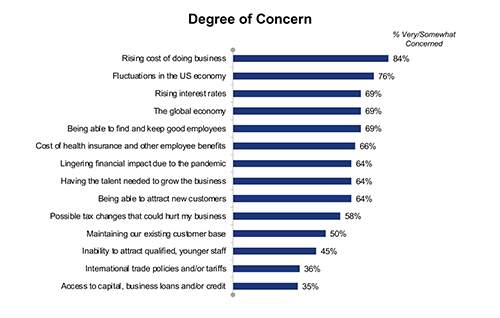

Another fallout of the pandemic, along with the war in Ukraine, is historic inflation that has persisted throughout 2022. To ease inflationary pressures, throughout the year, there have been predictions that the Federal Reserve would raise interest rates to slow the economy. In late July, the Fed enacted its second consecutive 0.75 percentage point rate increase, which took its benchmark rate to a range of 2.25% to 2.5%. Small business owners’ top concerns reflect these new realities on both a U.S. and global scale.

“While small business executives’ top concerns are things that are out of their control, I would caution them not to make assumptions about their ability to expand or borrow during times like these,” Schrider said. “The right financial partner can help you navigate this environment and keep your growth plans afloat. Look for a banker who has a ‘work-with-you’ approach, because there may be multiple solutions you can explore during various interest rate and economic cycles.”

Where there’s optimism

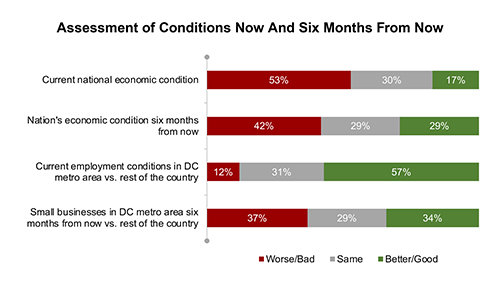

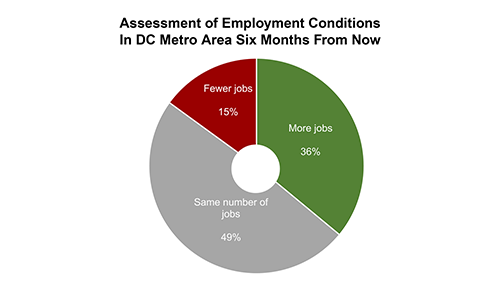

For all four years of the survey, a majority of respondents said current employment conditions in the D.C. metro area are better than conditions in the rest of the country.

Meanwhile, with several major economic development projects afoot, including Amazon’s H2Q project, there’s optimism about job growth in the region for the rest of the year. More government spending also could give small firms in the nation’s capital a chance to grow by winning more government contracts, Clower said.

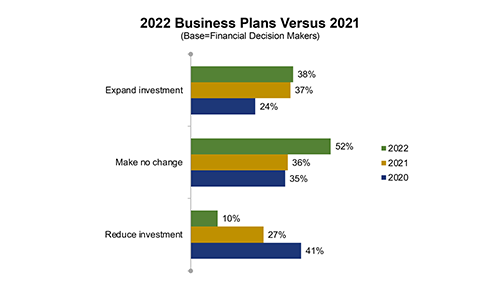

Many small business owners also are planning to expand investment in their business this year, a number that has increased for the third year in a row. Top investment priorities include workforce hiring (55%), marketing and advertising (51%), employee training/development (47%) and information technology (45%).

Clower said even though interest rates have risen, the record investment capital companies raised in 2021 is being put into play this year. He said there’s a big push in the region where universities are supporting small businesses with their product development work. The 2022 small business survey found that 38% of respondents plan to invest in the creation of new products and services over the next year.

“We think the development of the product-based entrepreneurial ecosystem is the next big goal for the regional economy,” Clower said.

Tom Dvorak, president of Baltimore-based commercial-industrial electrical contractor Dvorak LLC, said the company continues to invest in training, mentorship, and appropriate technology solutions. Given the competitive job market, some small business owners are also balancing employee preferences.

“Our largest adaptation has been to work with our employees, providing flexible in-office schedules and continuing to use remote and virtual applications when it makes sense,” Dvorak said. “Our company’s Vice President Brandon Weaver and Construction Manager Dale Merson has developed specific methods to keep our operations running at a high level while understanding the needs of our personnel in this labor-driven market.”

Meanwhile, Schrider said small firms will continue to take lessons learned during the health crisis to adapt and innovate.

“The pandemic accelerated technology investments, and small business owners opened new ways for their customers to do business with them,” Schrider said. “Businesses should continue to invest in technology, not to replace personal service, but to enhance it. Building personal relationships with your clients is the top priority and the key to long-term success.

Read the full research report. Join BBJ and Sandy Spring Bank for an in-person panel discussion and idea sharing session on September 15. The event will aim to provide support and assistance to the small business community. Get tickets.

Sandy Spring Bank has more than 50 locations across Maryland, Virginia and Washington, D.C.

Laura Newpoff is a freelance writer with The Business Journals Content Studio.

This publication does not constitute legal, accounting or other professional advice. Although it is intended to be accurate, neither the publisher nor any other party assumes liability for loss or damage due to reliance on this material.