This week we are thrilled to share this post by guest author Michael Limerez. Michael has been with Sandy Spring Bank for a number of years, starting just two weeks after his 18th birthday. He has worked in many areas of the bank, including Operations, the Client Service Center, and Treasury Services. He is currently the Manager of the Treasury Management Service and Support area of the bank.

How important is financial literacy, really?

As a culture, we ask young people to make many important financial decisions early in life. Whether it’s buying a car, college loans or managing a credit card for the first time, the under-30 set are making key decisions that will impact the rest of their lives. Many young people are not equipped with the tools that they need to navigate these decisions, which, in turn, can lead to financial stress at a time when they can least afford it. The FINRA Investor Education Foundation’s 2021 National Financial Capability Study reports that respondents who scored above the median on a seven-question financial literacy quiz were more likely to make ends meet than those with lower financial literacy. These respondents typically saved more than their counterparts (53% vs. 35%), and were more likely to set aside at least three months’ worth of emergency funds (64% vs 42%). So where do we start with financial education, and how exactly should we go about it? First and foremost, it starts at home.

It’s never too early to start.

Though it may seem like talking to young children about money management is an exercise in futility, keep in mind that kids often learn how to navigate the world by mimicking the actions of their parents. As any parent will tell you, the early stages of someone’s development are often when they are absorbing and learning the most. There are many resources available to help kids start to understand the importance of things like budgeting, saving, and credit. From apps to books, seek out age-appropriate resources that might help make the experience of learning about financial management more interactive and kid-friendly.

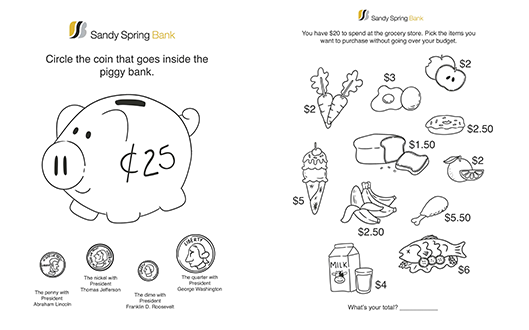

Help your child learn more about financial literacy through Sandy Spring Bank coloring pages. You can help your little one learn about budgeting with the grocery store checkout coloring page or about currency with the piggy bank coloring page.

Use every day scenarios

There are many exercises that you can perform that will help your child understand the basics of money management. Vacations when I was young were opportunities to teach, and on one trip my parents decided to start my financial education. Giving me a lump sum for the entire trip, it was my responsibility to then mete it out. Kids are kids though, and soon all I had left was an upset stomach from all the candy I purchased. It was a good first lesson in money management that I’ve never forgotten.

You can perform these kinds of exercises at the grocery store by giving kids a small budget to select ingredients for a family meal, or even by encouraging their participation in decisions about where to spend family vacations based on the family budget. When we were teenagers, my sister and I were also given a budget for school clothes. Tough decisions had to be made when deciding whether or not to blow all of our money on one nice pair of sneakers, or focus on things like jeans, socks, and t-shirts. These were important lessons that I didn’t even realize I was learning, and they helped me manage my money later on in life as I entered the work force.

Share age-appropriate stories with your child as cautionary tales or parables.

My dad told me a story about a friend of his when I was about 14. This friend saved money by working at a gas station all summer long. Once school resumed, the friend went out and bought a brand new car to impress the rest of the class. While it was indeed a nice car, the friend could not drive it for weeks as he had no money for gas, spending it all on the car. Share cautionary tales with kids as they grow. Learning about real world missteps or successes will reinforce much of the guidance that you have been instilling in them over their lifetime. While no one likes to relive mistakes made in the past, sharing stories of mistakes you or a family member made might just help your child avoid similar pitfalls.

Don’t forget about credit hygiene!

The final piece of the financial literacy puzzle to discuss with your kids is arguably the most important - credit. According to a Lending Tree survey, as of the end of 2022, Americans had accumulated $986 billion in credit card debt. Sure, it's true that credit can be a valuable tool when securing one's financial future. But all too often credit is misused, which can have significant negative consequences. It is key that your kids understand how interest accrues and how it affects the value of an item. Talk with them about all the ways in which credit can affect them and the importance of paying off balances and why sometimes you want to carry a balance. There are some really great resources available to help teach your kids about credit and having a good credit history so be sure to take advantage of them.

Talking to your kids about finances may at first elicit a groan or an eye roll, but what doesn’t with kids? Understanding the fundamentals of personal finance are valuable lessons that they’ll use throughout their lives and who knows, maybe one day they’ll even thank you for it.

Questions? Contact us today at 800.399.5919 or visit a Sandy Spring Bank branch near you to discuss your banking needs.

This publication does not constitute legal, accounting or other professional advice. Although it is intended to be accurate, neither the publisher nor any other party assumes liability for loss or damage due to reliance on this material.