Small Business Administration Paycheck Protection Program

The Paycheck Protection Program, better known as PPP, is a stimulus program created by the Coronavirus Aid, Relief, and Economic Security (CARES) Act to help small- and medium-sized businesses affected by the COVID-19 pandemic maintain payroll, hire back employees who have been laid off and cover applicable overhead. Although the Small Business Administration (SBA) is no longer accepting PPP applications, the forgiveness process is ongoing.

Information current as of March 30, 2022.

PPP Forgiveness

Loans Under $150,000.

Sandy Spring Bank is no longer accepting forgiveness applications for PPP

loans under $150,000. Borrowers must

apply for forgiveness directly

through the Small Business Administration.

APPLY DIRECTLY

Loans of $150,000 or More.

The Sandy Spring Bank PPP loan forgiveness portal remains open for all loans of $150,000 or above.

Portal Instructions » | Required Documents Checklist »

Portal Status: Open

Apply Now

For the latest Small Business Administration (SBA) information on PPP loan forgiveness, click here.

About PPP Forgiveness

Important information on the forgiveness application process

- Refer to the U.S. Treasury’s website or the SBA’s website for up-to-date information on forgiveness and documentation requirements.

- For help with our forgiveness application portal, please review the frequently asked questions below.

If you are experiencing any issues resetting your portal password:

- Ensure the email address you are using to log in is the email address the authorized signer used to apply for the loan.

- Check your junk, spam, or email quarantine folders for messages from pppqa@sandyspringbank.com . Please do not attempt to send a message to this address as it is not monitored.

- Add pppqa@sandyspringbank.com to your contacts, safe senders list, or whitelist to ensure you receive the password reset email.

- If applicable, check with your IT team to make sure your company is not filtering messages from pppqa@sandyspringbank.com

PPP Repayment Guidelines

The U.S. Congress revised the PPP so that borrowers are no longer required to begin repayment six months after the date of the loan.

After you complete your application for forgiveness of your PPP loan, we will notify you when we receive the forgiveness amount from the SBA. If the forgiveness amount is less than 100% of the PPP loan balance, you must repay the portion of the PPP loan that is not forgiven. Monthly payments of principal and interest on such amount will commence after the portion of the loan that is forgiven is transmitted to the Bank. We will also inform you of the amount of your monthly payment and the date on which your monthly payments are due. If you apply for forgiveness of your PPP loan, monthly principal and interest payments will commence on the date on which the portion of the loan that is forgiven is transmitted to the lender.

- The Bank has 60 days from receipt of a complete forgiveness application to issue a decision to SBA. SBA then has 90 days to review the loan or forgiveness application and remit the appropriate forgiveness amount to the Bank.

- Please note that our branches and the Client Service Center do not have additional information on PPP forgiveness.

If you fail to apply for forgiveness of your PPP loan within ten (10) months after the last day of the 8- or 24-week covered period for using the PPP loan proceeds, you must begin making monthly principal and interest payments. In such event, the Bank will specify the date on which your monthly payments are due.

These changes are intended to give borrowers the opportunity to complete the forgiveness application process before any payments are due.

If you have additional questions that are not addressed here, please submit your question using the "Ask a Question" button above.

Paycheck Protection Program (PPP) Forgiveness Portal FAQs

For the latest information about SBA PPP loan forgiveness directly from the SBA, please visit this page.

-

Question

I have a PPP loan under $150,000. How do I apply for forgiveness?

AnswerSandy Spring Bank is no longer accepting forgiveness applications for PPP loans under $150,000. Borrowers with PPP loans under $150,000 must apply for forgiveness directly through the Small Business Administration.

Visit https://directforgiveness.sba.gov/ to apply.

-

Question

I received a PPP loan from Sandy Spring Bank and am interested in applying for forgiveness. I received an email with a link to apply. What is the next step?

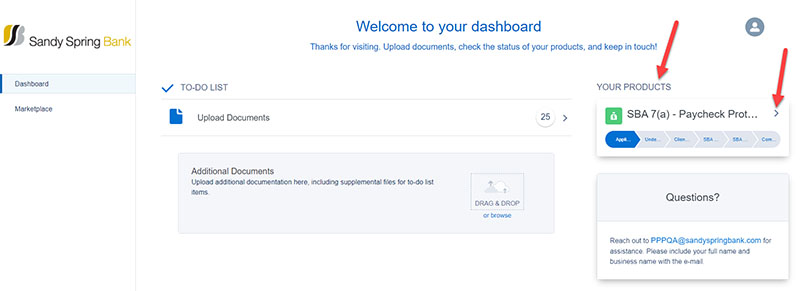

AnswerTo access the PPP forgiveness application, click here, or log in using the link you received in the email. You’ll then see the dashboard. Click on Marketplace on the left and then click the “Apply” button for PPP forgiveness application.

-

Question

What should I do before I start my application?

AnswerYou may wish to complete the appropriate 3508 forgiveness form so that you have all of the information ready to enter into the portal. It is necessary to enter your information directly into the portal to apply for forgiveness. And, gather your backup electronic documents such as payroll register, bills/invoices and proof of payment for things like utilities, internet, or mortgage insurance in order to upload those documents to the portal. Your application will be processed faster if all of the required documentation is provided.

SBA PPP application forms:

- PPP Loan Forgiveness Application Form 3508S »

- No required supplemental documents (pending SBA guidance)

- PPP Loan Forgiveness Application Form 3508S »

-

Question

What is forgivable?

AnswerThe CARES Act lists two categories of expenses that are forgivable: "Eligible payroll costs" and "Eligible nonpayroll costs". This means that your PPP loan is forgivable to the extent you spend the proceeds of your loan on these two categories, subject to possible reduction if you reduce the headcount and salaries of employees from pre-Covid-19 levels. Another important requirement is that you actually pay for or incur these expenses during the “covered period” or "alternative covered period" (if you qualify). Based on the Paycheck Protection Program Flexibility Act of 2020 signed into law on 6/5/20, at least 60% of the PPP Loan must be spent on "Eligible payroll costs" and up to 40% can be spent on "Eligible nonpayroll costs".

Eligible Payroll Costs

- Compensation to employees

- Employer contributions for employee health insurance

- Employer contributions to employee retirement plans

- Employer state and local taxes assessed on employee compensation

- Compensation to owner-employees/self-employed individual/general partner not included in compensation to employees.

Eligible nonpayroll Costs

- Interest on Covered Mortgages

- Expenses for Rent or Lease Payments

- Utility Expenses

-

Question

Can I upload all my documents at once?

AnswerIt is necessary to upload documents individually.

-

Question

Do I have to apply for PPP forgiveness on the Sandy Spring Bank forgiveness application portal?

AnswerYes, you must apply for forgiveness using the Sandy Spring Bank online forgiveness portal. We cannot accept paper forms or other types of forms.

-

Question

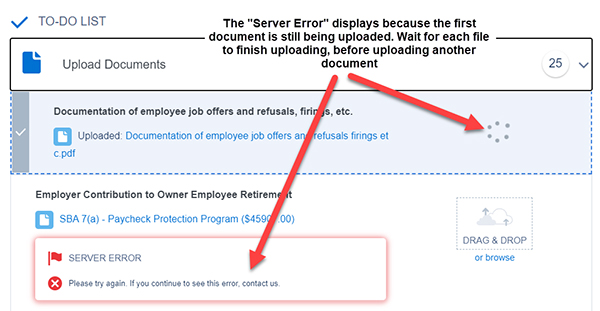

I am uploading documents and getting an error message.

AnswerYou can only upload one document at a time. Be sure to wait until the first one is finished uploading and then upload your next document. If you try to upload another file while the first is still uploading, you’ll get a “SERVER ERROR.”

-

Question

Where do I find my Sandy Spring Bank PPP loan number?

AnswerYour PPP loan number will be pre-filled in the forgiveness portal.

-

Question

Will I need my SBA PPP loan number?

AnswerYour Small Business Administration PPP loan number will be pre-filled in the Sandy Spring Bank forgiveness portal.

-

Question

What is the NAICS code? Is this a mandatory field?

AnswerThe NAICS code was developed by the Federal Statistical Agencies for the collection, analysis and publication of statistical data to the US Economy. It lists each business type and/or industry. You can find your NAICS code at: www.naics.com/search/. The NAICS code must be filled in on the PPP forgiveness application.

-

Question

Can I save my application and come back to it? Will I lose the information I entered?

AnswerYes. You can click the Save and come back later at the bottom of any page to save what you’ve entered. Then when you come back, expand the Incomplete Applications section on your dashboard to see the application that’s still in process. Click on it, and you’ll return to the last page you completed.

-

Question

What is the status of my application?

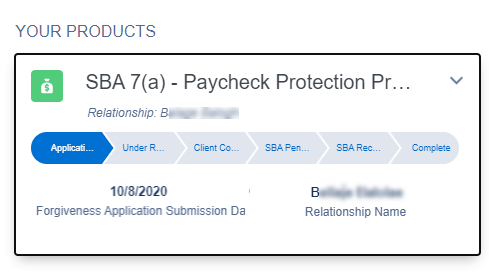

AnswerLog into the portal and you’ll see “YOUR PRODUCTS” on the top-right side of the page. Click the drop-down arrow to the right to open the box and you’ll see the date you submitted your application, along with a visual progress bar. Your application will move through these stages:

Loan Status This means... Application Submission Sandy Spring Bank has received your submitted forgiveness application. Under Review The Sandy Spring Bank team is doing a thorough review and evaluation of your forgiveness application and all of the documentation you submitted. Client Communication Pending Your application is now with our Client Communication team, and you’ll soon be notified with the results of our evaluation prior to submitting your application to the SBA SBA Pending Your application and our decision has been submitted to the SBA, and we are waiting for the SBA to evaluate your application SBA Decision We have received the SBA’s decision and will contact you. Complete Forgiveness application process is complete.

Not finding the answer to your question above?

Keep in Mind

We are aware that third parties are contacting PPP recipients to assist them with their forgiveness applications, presumably for a fee. We have not engaged with and do not endorse any of these firms, nor have we provided any of these firms with information about our PPP borrowers.