-

Disclosure

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Sandy Spring Bank and SavvyMoney are not affiliates. They are not related through complete or partial common ownership, joint venture partnership and/or strategic business partnership. No party will have any right, power or authority to assume or incur any obligations or liabilities, express or implied, on behalf of or in the name of the other.

SavvyMoney® is a registered trademark of SavvyMoney, Inc.

Personal Digital Banking

Personal Digital Banking

-

Card Management – Turn cards on or off, view activity, change your PIN and more.

-

Mobile Banking – When on the go, use our mobile app to keep track of your Sandy Spring Bank accounts. Learn more. »

-

Mobile Check Deposit – Use your mobile device to deposit up to three checks at a time.

-

Receive and Pay Bills – Get on-the-go bill management when you enroll in Bill Pay.

-

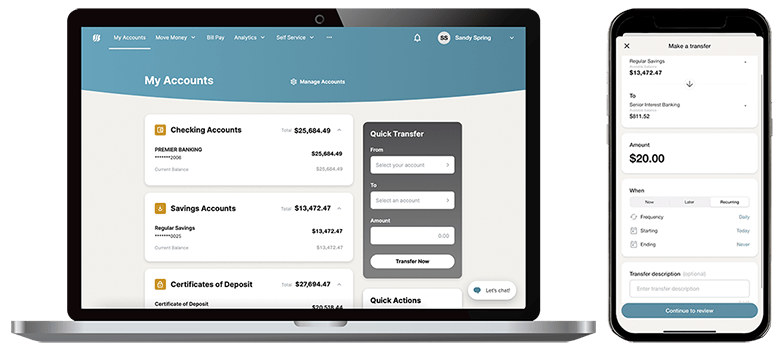

Make Transfers and Payments – Schedule one-time and recurring payments using your mobile device.

-

Access to Zelle® – Zelle is a fast, safe way to send and receive money. With Zelle, you can split the cost of a bill, request money for a group gift, or pay back your roommate for your share of the rent. Learn more. »

-

Quick Transfer – Make transfers directly from your Sandy Spring Bank account page, whether at home or on the go.

-

Security – Industry-leading technology to help you manage your security.

-

Customized Security Notifications – Secure your account with SMS alerts and opt-in push notifications.

-

Loans and Mortgages – Access a simplified view of your loan and mortgage statements.

-

Personal Finance Management – Utilize desktop tools for budgeting, expense tracking and more.

-

Lock Registered Devices – Lock and help secure lost mobile devices via your desktop.

-

eStatements – Go green and receive statements two to three days earlier than you do with postal mail. Electronic Statements include images of paid checks, can be saved to your computer, and stay in the system for up to two years. Learn more. »

-

Credit Score by SavvyMoney® - Free access to your latest credit scores and reports, real-time credit monitoring, and more. Learn more. »

Looking for the Personal Digital Banking login?

Click on the red Login to Online Banking box at the top of this page.

-

Question

How to - Personal Digital Banking External Transfer Demo

Answer -

Question

How to - Personal Digital Banking Mobile Banking Demo

Answer -

Question

How to - Personal Digital Banking Mobile Deposit Demo

Answer -

Question

How to - Personal Digital Banking External Transfers Demo

Answer -

Question

How to - Personal Digital Banking Bill Pay Demo

Answer -

Question

How to - Personal Digital Banking eBills Demo

Answer -

Question

How to - Personal Digital Banking Personal Financial Management Demo

Answer