By Laura Newpoff, Contributor The Business Journals Content Studio

Small businesses continue to make changes to their business models and strategies as they adapt to an economy in recovery mode from Covid-19 and a world that’s become increasingly digital.

In this next phase of the pandemic, finding new ways to deliver products and services, implementing new technology and staying more connected to customers and clients are the most popular changes these firms have made during the first half of 2021.

Those insights are among the key findings from The Washington Business Journal’s third annual State of Small Business Survey, sponsored again by Sandy Spring Bank. The research focused on understanding how small businesses are faring and what they need to succeed.

To read more about the survey methodology and its overall results, including top challenges and investment priorities for small businesses, click here.

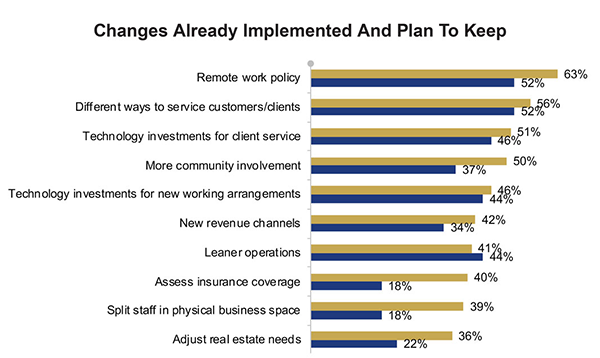

Among changes that have been made that small firms plan to keep, the top three responses all relate in some way to the digital transformation journey – remote work policies (63%), different ways to service customers and clients (56%) and technology investments for client service (51%).

“The pandemic accelerated the need for digital transformation across industries,” said Daniel J. Schrider, Sandy Spring Bank’s president and CEO. “Small firms have found ways to deliver products and services to clients in ways they’ve never done before, and technology has been critical to making that happen.”

Case studies: Implementing new technology and finding new ways to deliver products and services

Prior to the pandemic, Washington, D.C.- based CSI DMC produced 1,400 events annually across the U.S. and internationally, including special events, customized dining and entertainment experiences, unique activities and teambuilding sessions. Covid-19 led to a massive number of cancellations, which prompted the company to rethink how it would reposition the business with in-person gatherings halted.

“We took our expertise in a different direction to produce virtual experiences,” said Amberlee Huggins, chief marketing officer. “They are different from in-person events but still can be highly successful.”

CSI DMC produced 621 virtual experiences in 2020 and trained employees to become digital event specialists. The virtual offerings were such a hit that they’ve become a permanent part of the company’s portfolio.

To offer virtual experiences, CSI DMC blended creative ideation with software integration and high-quality streaming. Virtual became a new reality, and technology allowed people to participate in 354 reimagined experiences online, like exercise and cooking classes, songwriting sessions and food and wine tastings.

For the company’s business and association clients, it was important to offer conference and virtual networking environments. One networking event had guests arrive virtually at the Washington National Cathedral and allowed them to move among a number of networking sessions, take a mixology class or watch live entertainment.

“Being in Washington, D.C., as an event specialist, you’re always thinking about a ‘plan B.’ At any moment, a motorcade could be coming down the street that disrupts everything you had planned,” Huggins said. “For plan B with Covid-19, it made complete sense to invest in our creativity, technology to support virtual events and train our employees to be virtual event experts.”

Mace Medical in Essex, Maryland, stayed open throughout the pandemic but decided early on to encourage as many patients as possible to use technology to interact with its physicians. Prior to the health crisis, the organization had invested in an electronic health records system that allowed physicians to perform telemedicine and access a patient’s chart simultaneously. Just 10% of patients used it, however, said Mace Medical’s Dr. Chukwuma Ebo.

“The first lesson we learned early on in the pandemic is you have to meet folks where they are,” Ebo said. “We found out pretty quickly that folks were more comfortable with Zoom than they were with the portal.”

The practice got together with a group of independent doctors and purchased a Zoom product that was HIPAA-secure. Suddenly, doctors at Mace Medical were able to boost remote treatments even for elderly patients whom one might assume are tech-averse.

“We asked them — ‘Do you use Zoom?’ They’d say, ‘Oh, of course. I’ve been using Zoom to talk to my grandkids,’ ” Ebo recalled. For those who didn’t have laptops or smartphones, the practice enlisted family members and neighbors to host the online visits.

A third platform, Doximity, allowed Ebo to interact with patients much in the same way he’d chat with someone over FaceTime without having to provide them with his cell phone number.

Moving forward, the practice continues to try to get patients comfortable with the health portal, and 70% of them are now enrolled. Mace Medical also has used technology to reduce in-person patient-staff interactions through digital kiosks that allow check-ins, check-outs and bill pay.

“That’s one of the more recent investments we’ve made to try to continue on our journey toward integrating more technology into our practice,” Ebo said. “The pandemic caused us to see the light. We now see how technology can help us be better doctors.”

Accelerating tech adoption is critical

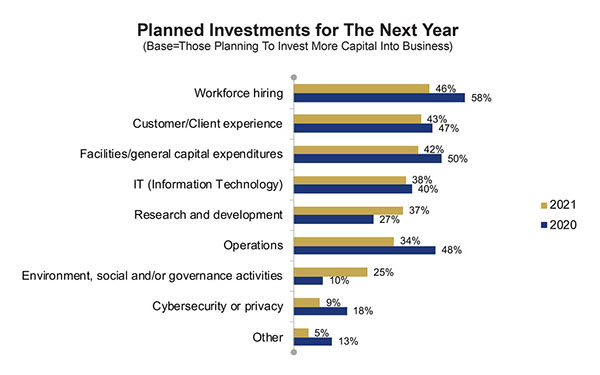

The State of Small Business survey found that 37% of respondents expect to expand investment in their business this year, up from 24% a year ago. Thirty-eight percent of those firms will make information technology investments, down slightly from 40% a year ago.

Boosting small business technology investment would be a boon to the American economy, the U.S. Chamber of Commerce reports. That’s because studies have shown that 73% of small businesses are not aware of digital resources, such as online payment processing tools, online productivity tools, e-commerce websites, online marketing and other tools that can help them reach customers around the world.

According to the Chamber: “If small businesses had better access to global markets, it could increase the (gross domestic product) of the United States by $81 billion and add 900,000 new jobs. During the pandemic, this could also mean the difference between thriving and closing for good.”

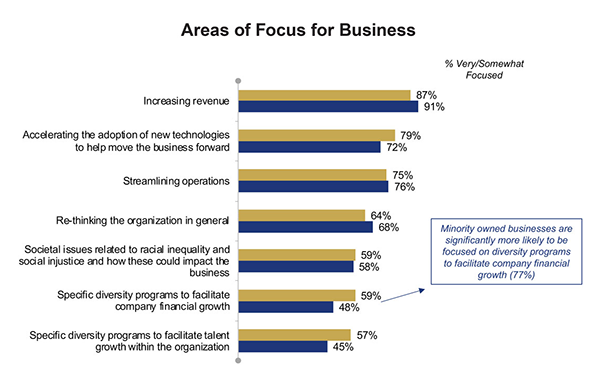

Many small businesses in the region understand this, and 79% percent of those surveyed plan to accelerate the adoption of new technologies to help move their businesses forward, up from 72% a year ago. Access to capital is critical to making this a reality for many.

“Financial institutions have a lot of money to lend, but the pandemic highlighted the importance of having a relationship with your local banker to talk through evolving business models and how changes in strategy would impact your investments,” Schrider said. “Technology investments will continue to be needed in a competitive economy that requires small businesses to connect with clients and consumers where they are. Increasingly, those connections are happening through digital channels.”

To learn more about how Sandy Spring Bank is helping small businesses grow, click here.

Sandy Spring Bank has more than 50 locations across Maryland, Virginia and Washington, D.C.

Read more Small Business research findings »

Laura Newpoff is a freelance writer with The Business Journals Content Studio.

Source: The Washington Business Journal’s third annual State of Small Business Survey, sponsored by Sandy Spring Bank.

The Washington Business Journal is not affiliated with Sandy Spring Bank.

This material is provided solely for educational purposes and is not intended to constitute tax, legal or accounting advice, or a recommendation for any particular transaction.

Websites not belonging to this organization are provided for information only. No endorsement is implied.