Survey Reveals Small Business Insights About Talent Attraction and Retention

By Laura Newpoff, Contributor, The Business Journals Content Studio.

Attracting and retaining workers is a top concern of small businesses in the Greater Washington, D.C. and Baltimore regions. In this next phase of recovery from the pandemic, remote work policies, technology investments and diversity and equality initiatives are at the top of to-do lists to ease the pain of what’s become a chronic labor shortage.

That’s according to the Washington Business Journal’s third annual State of Small Business Survey, sponsored again by Sandy Spring Bank. The purpose of the research is to understand how small businesses are faring and what they need to succeed.

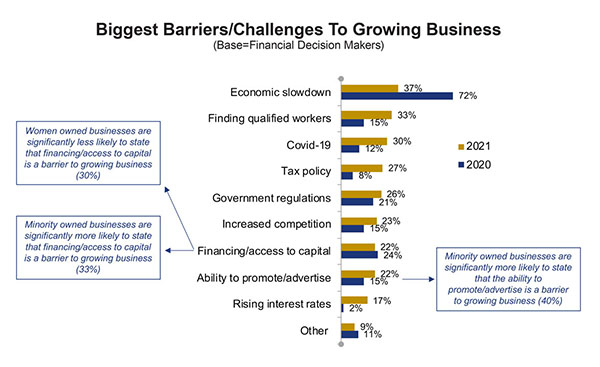

While small businesses are largely positive about the regional and national economies, they face challenges. Finding qualified workers was cited by 33% of respondents as the biggest barrier to growing a business, up from 15% a year ago.

Terry Clower, director of the Center for Regional Analysis at George Mason University, said the pandemic is causing millions of jobs to sit empty and businesses to lose sales opportunities.

“You can’t expect somebody who’s worked for years in the hospitality sector to all of a sudden go into the technology sector and succeed,” Clower said. “There are cultural differences, and that’s become a key challenge for small businesses. They simply don’t have the capacity or time to engage in big nationwide searches to find people to hire.”

To read more about the survey methodology and its overall results, including top challenges and investment priorities for small businesses, click here.

Here are key findings related to talent attraction and retention.

Finding an edge

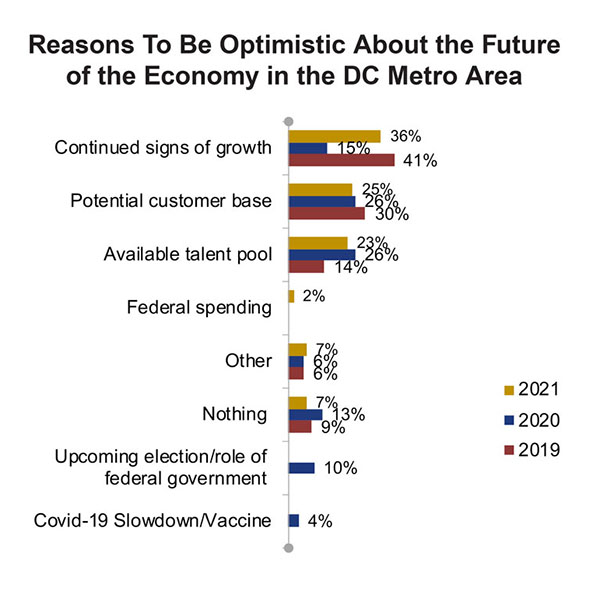

Just 23% of respondents expressed optimism about the available talent pool, which is down from 26% a year ago but up from 14% in 2019.

Sixty-eight percent of women-owned firms are currently concerned about the talent issue, compared with 48% of non-women-owned firms. And 59% of respondents are concerned about having the talent needed in six months to grow their business because of the pandemic, up from 39% in 2020.

Clower said small businesses would be well served by focusing their recruiting efforts on younger generations who are attracted to small teams, entrepreneurial settings and family-friendly, flexible environments.

“There’s been a shift over the decades. The old thinking was that you’d go to a bigger company, stay there a long time and look for advancement opportunities,” he said. “Today’s younger generations really don’t think about going to work for one employer and being there for 30 years. It’s a different mindset that might give small businesses an edge to compete for talent.”

Remote work

Cited by 46% of those who plan to invest in their business in the next year, workforce hiring is the top planned investment for the next year, which is down from 58% a year ago.

“Continued planning for workforce hiring demonstrates that market opportunities for most small businesses remain strong,” said Clower. “Though the data do not say this explicitly, the drop in the percentage of those businesses planning to expand hiring may be indicative of building frustration among leaders when it comes to finding qualified workers. In other words, they may be simply giving up on hiring for the moment.”

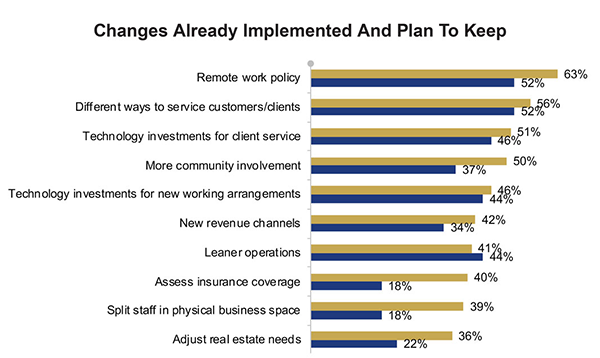

Sixty-three percent of respondents said they’ve implemented and plan to keep remote work policies, up from 52% a year ago. Forty-six percent will continue to make technology investments for new working arrangements, up from 44% in 2020.

Amberlee Huggins, chief marketing officer at destination and event management business CSI DMC, said providing remote work flexibility demonstrates a commitment to viewing employees as people and not positions.

“You never want to lose people over small variances,” she said. “If someone needs to work remote so it’s easier to pick up their children from school at 3 p.m., you work through that because losing that individual will cost you — and not just in terms of what you’ll spend to replace that person. It also comes with the psychological cost it has on the team environment.”

Diversity focus

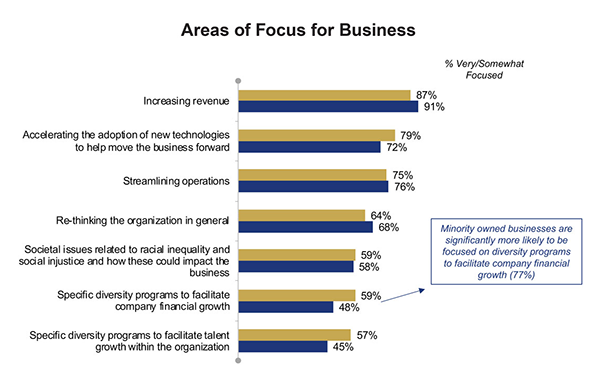

Fifty-seven percent of those surveyed said they are focused on specific diversity programs to facilitate talent growth within the organization, up from 45% a year ago.

The top efforts being made to promote diversity and equality within companies are: providing a safe platform for employees to express their voice (52%), offering meaningful opportunities for employee engagement with management (48%) and a commitment to ensuring unbiased reviews of all employee applications (47%).

“We look to provide an environment for all to feel safe and confident in communications with peers and management,” Huggins said. “Through HR procedures and ongoing training about our organizational culture, we look to provide a fair and authentic review of all employee applications for new jobs and/or growth opportunities within the organization.”

More flexibility and a focus on equality fit in with what Clower describes as “shifting expectations of work. There’s information that suggests to us that younger generations care about issues that extend beyond being focused just upon a salary.”

To learn more about how Sandy Spring Bank is helping small businesses grow, click here.

Sandy Spring Bank has more than 50 locations across Maryland, Virginia and Washington, D.C.

Read more Small Business research findings. »

Laura Newpoff is a freelance writer with The Business Journals Content Studio.

Source: The Washington Business Journal’s third annual State of Small Business Survey, sponsored by Sandy Spring Bank.

The Washington Business Journal is not affiliated with Sandy Spring Bank.

This material is provided solely for educational purposes and is not intended to constitute tax, legal or accounting advice, or a recommendation for any particular transaction.

Websites not belonging to this organization are provided for information only. No endorsement is implied.