Small Business Executives Say They’re Bullish on the Metro Area’s Outlook, but New Survey Finds Issues Where They Want Help

By Laura Newpoff, Contributor, The Business Journals Content Studio

Economic recovery from the pandemic has remained strong in 2021, and small businesses in Greater Washington, D.C. and Baltimore are bullish on their prospects and on the region’s business climate for the rest of the year.

At the same time, small firms are in need of resources to help their businesses grow as they look to stay competitive in the areas of digital transformation, remote work, cybersecurity and talent attraction and retention.

Those are among the key findings from The Washington Business Journal’s third annual State of Small Business Survey, sponsored again by Sandy Spring Bank. The purpose of the research is to understand how small businesses are faring and what they need to succeed.

“The data confirms what we are seeing and hearing from our clients: small businesses feel positive about this next phase of recovery from the pandemic,” said Daniel J. Schrider, President and CEO of Sandy Spring Bank. “These small firms continue to alter their business models to respond to the pandemic. They are finding new ways to deliver products and services, implementing new technology, and staying more connected with customers and clients.”

A total of 292 business executives with businesses of less than $25 million in annual revenue were surveyed in the second quarter of this year. In the group was a sub-sample of 109 respondents from businesses with fewer than 500 employees and revenue under $5 million.

Terry Clower, Northern Virginia chair and professor of public policy at George Mason University, said research like this is important because it allows those who monitor the regional economy to gauge what opportunities small firms are seeing and what roadblocks remain in place. He said plenty of opportunities were seized upon by these firms over the past 18 months.

“Small businesses often are a case study in innovation,” Clower said. “Businesses across industries adapted to market circumstances and led the way in both product innovation and process innovation.” He cited the way restaurants had to change operations to continue to serve customers and the way real estate transactions went digital as two examples of innovation.

Here are the survey’s key findings.

Economic outlook

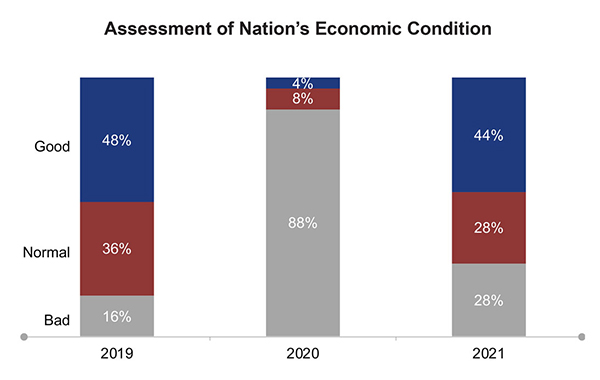

The economic recovery is underway, and optimism about the nation’s economy is almost back to pre-pandemic levels. When asked whether the economy was good, normal or bad, here are their responses.

For all three years of the survey, nearly all respondents said employment conditions in the D.C. metro area are better than or the same as in other parts of the country. And 55% of respondents said there will be more jobs in the region six months from now than in other parts of the country, which is up from 32% a year ago and 43% in 2019.

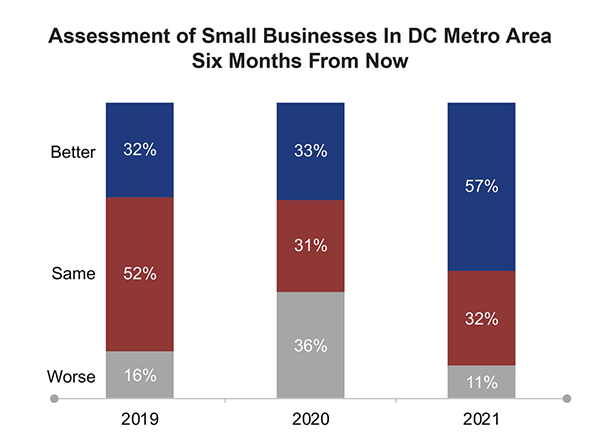

Meanwhile, 57% of respondents said D.C.-area businesses will be better off than businesses in other parts of the country six months from now, which is significantly higher than 33% a year ago and 32% in 2019.

Schrider said those favorable responses about the region reflect its diversity of industries – including health care, biomedical, cybersecurity, research, defense and technology – combined with the stability of the federal government and proximity to prestigious higher learning institutions. The opening of Amazon’s HQ2 in Arlington County, Virginia, also could result in 25,000 new jobs by the mid-2030s.

Barriers to growth

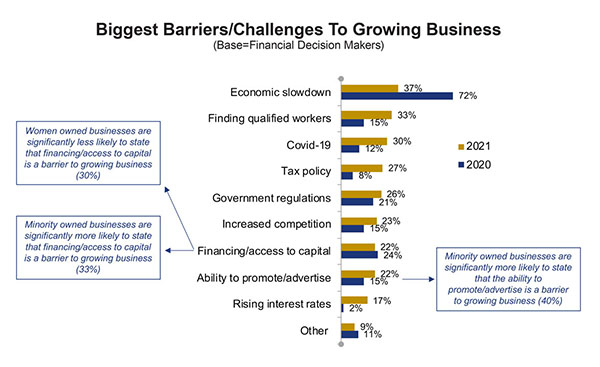

Small firms in the area anticipate some difficulty growing their businesses but not to the extremes seen last year.

Aside from the pandemic, the areas considered the biggest barriers to growth this year compared with 2020 are:

- Finding qualified workers: 33% now compared with 15% in 2020.

- Tax policy: 27% now compared with 8% in 2020.

- Rising interest rates: 17% now compared with 2% in 2020.

The survey also revealed that 33% of minority-owned businesses said access to capital was a barrier to growth vs. 22% of all respondents.

The pandemic accelerated the deployment of digital tools consumers and businesses need to bank remotely, which has made many services more convenient, Schrider said. However, for minority-owned firms and other small firms that consider access to capital a pain point, face-to-face interactions and relationships remain important.

“We can put all the digital channels out there for small businesses, but when push comes to shove, you need to know somebody who knows your business, your plans and your challenges,” he said.

Aside from talent, the areas that recorded a higher degree of concern this year vs. 2020 were:

- Cybersecurity risks: 70% now compared with 59% in 2020.

- Supply chain disruptions: 65% now compared with 54% in 2020.

- The ability to effectively manage hybrid or remote work: 43% now compared with 35% in 2020.

Hugh Sisson, founder of Heavy Seas Beer in Baltimore, said three strategies allowed his company to make it through this time of uncertainty. Before the pandemic his company had 2,000 points of distribution for draft beer. By April 2020, that went down to six.

- Cash is king. Cash reserves and the Paycheck Protection Program allowed him to keep all of his workers employed.

- Clear job functions allowed people to transition seamlessly to remote work.

- Protecting “personnel infrastructure” benefitted the company during a tight labor market and allowed him to focus on core operations and not spend time recruiting employees.

“When the world began to reopen again, we were in a position where we didn’t have to do a mad scramble to find workers,” Sisson said. “It’s hard to recruit labor and being able to keep the employees we had really was a blessing.”

Changing business models

Many small businesses continue to alter their business model or strategy because of the pandemic, and 30% of respondents said those changes have had a positive impact. Half the respondents said the changes have had no impact or don’t know yet, and 20% said they had a negative impact. In 2020, 38% said their changes had a positive impact and 43% replied it had no impact or don’t know yet.

The top business model changes in the first half of 2021 were:

- finding new ways to deliver products or services, 70%.

- implementing new technology, 67%.

- staying more connected with consumers and clients, 64%.

- expanding your market, 54%.

The top changes that have been implemented and will be kept are remote work (63%), different ways to service customers and clients (56%) and technology investments for client service (51%).

Business investment plans

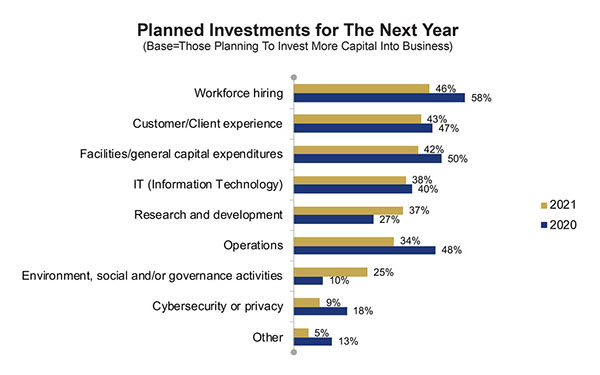

Thirty-seven percent of small firms will expand their investments this year, up from 24% in 2020. One group, minority-owned businesses, had 53% of respondents who replied they plan to grow their businesses by investing more capital this year.

Among planned investments, there was a significant increase in implementing environmental, social and/or governance programs this year – 25% compared with 10% in 2020. Spending on research and development also is expected to increase this year – 37% compared with 27% in 2020.

The top financial priorities for the next six to 12 months are recovery and growth (40%), managing cash flow (28%) and finding additional funding (10%).

To learn more about how Sandy Spring Bank is helping small businesses grow, click here.

Sandy Spring Bank has more than 50 locations across Maryland, Virginia and Washington, D.C.

Read more Small Business research findings »

Laura Newpoff is a freelance writer with The Business Journals Content Studio.

Source: The Washington Business Journal’s third annual State of Small Business Survey, sponsored by Sandy Spring Bank.

The Washington Business Journal is not affiliated with Sandy Spring Bank.

This material is provided solely for educational purposes and is not intended to constitute tax, legal or accounting advice, or a recommendation for any particular transaction.

Websites not belonging to this organization are provided for information only. No endorsement is implied.