-

Disclosure

View our Fair Lending Policy statement. »

Loan program subject to change without notice and cancellation at any time. Actual qualification is subject to verification and approval of income, credit, property appraisal and other factors. Additional fees, terms and conditions may apply. Other rates and terms are available. Please consult your tax adviser regarding tax deductibility.

Home Equity Line of Credit

1To open an account, you must pay certain fees to third parties such as appraisers, credit reporting firms and government agencies (closing costs). These third party fees generally total between $540.00 and $1,400 for a $50,000 line of credit. We will pay your closing costs, up to $5,000. You must pay any and all closing costs that exceed $5,000, including any applicable transfer taxes whether in part or in full. You will reimburse us for all closing costs that we paid on your behalf to third parties if the line is terminated (by you or us) during its first three years. Upon request, we will provide you with an itemization of these closing cost. Closing cost are not waived for purchase transactions.

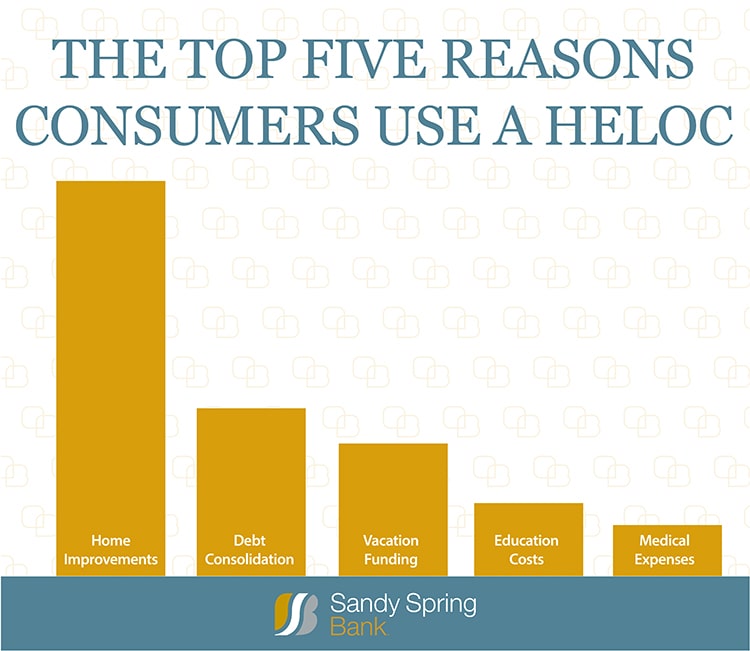

* According to Bankrate, https://www.bankrate.com/home-equity/reasons-to-use-home-equity/.

Home Equity Line of Credit

A Home Equity Line of Credit May Be the Ideal Solution

Is there a major home renovation you’d love to start? How about paying for college? Or even a dream trip you’ve always wanted to take? No matter your reason, the equity already in your home may be the perfect option for you, providing affordable access to additional funds whenever you need them.

What is a home equity line of credit?

A line of credit secured by your home that provides access to funds to use for a variety of purposes. It offers flexibility and is useful for projects with multiple purchases. Calculate your home equity line of credit payment ».

Easy & Accessible

- Convenient and easy access to available funds.

- Lower interest rates than other types of credit, including credit cards.

- No origination or annual fees.1

- The option to lock-in a portion of your outstanding balance at a fixed rate.

- Overdraft protection, linked to your home equity line of credit, helps to avoid overdraft fees.

- Interest rate discount of 0.25% for automated payments set up from a Sandy Spring Bank checking account at loan origination.

4 Reasons Clients Use a HELOC*

- Home improvements and additions

- Vacation funding

- Education costs

- Medical expenses

Frequently Asked Questions (FAQs)

-

Question

What are the differences between a home equity loan and a home equity line of credit (HELOC)?

AnswerDetermining whether a home equity loan or a HELOC is the better option for you depends on your needs and repayment goals. A home equity line of credit provides ongoing access to funds with flexible repayment options. A home equity loan provides a one-time disbursement of funds at a fixed rate.

Compare home equity loans and lines of credit. »

-

Question

How much can I borrow with a home equity line of credit?

AnswerWell qualified applicants may borrow $20,000-$700,000 depending on the equity in their home, credit rating and other factors.

-

Question

How long are home equity line of credit terms?

AnswerHome equity lines of credit feature a 10 year draw period and 30 year repayment.

-

Question

Are there closing costs or other fees with home equity lines of credit?

AnswerThere are no annual fees and most closing costs are waived with lines of credit.1

-

Question

Are any discounts available with home equity lines of credit?

AnswerA 0.25% discount is available when payments are automatically deducted from your Sandy Spring Bank checking account at loan origination.

-

Question

Is interest paid on a home equity loan or a home equity line of credit (HELOC) deductible?

AnswerIt depends.

For tax years 2018 through 2025, if home equity loans or lines of credit secured by your main home or second home are used to buy, build, or substantially improve the residence, interest you pay on the borrowed funds is classified as home acquisition debt and may be deductible on interest taxes, subject to certain dollar limitations. However, interest on the same debt used to pay personal living expenses, such as credit card debts, is not deductible.